Five Projects with Real-World Revenue Scenarios Utiling Token Empowerment

Author | defioasis

Memecoin once captured significant attention and investment with its unique culture, humorous image, and community-driven characteristics. The fair launch mechanism of pump fun further propelled the Meme frenzy to new heights. However, as PvP intensified and the speed of new launches accelerated, the so-called narrative logic, Meme symbols, and community culture have largely disappeared. The key now lies in who is promoting the token, as the identity, status, background, and resources determining the peak price a memecoin can achieve in the short-term spotlight, only to leave chaos in its wake once the excitement fades.

With U.S. President Trump and Binance founder CZ joining the fray to "promote" Memecoins, the role of Memecoin as a pure vehicle for attention-driven speculation seems to have peaked, as there are few figures of higher status than these two. Many users have also begun to feel fatigued. In contrast to fair launches, despite issues like high valuations and low efficiency associated with VCcoins, sustainable projects with clear business models, real revenue streams, and the ability to empower tokens are likely to stand out in the volatile crypto market. This article will review five projects in the current market that boast strong real revenue streams and are actively using them to empower their tokens.

(1) Hyperliquid: Trading Fee Revenue Used for Token Buybacks

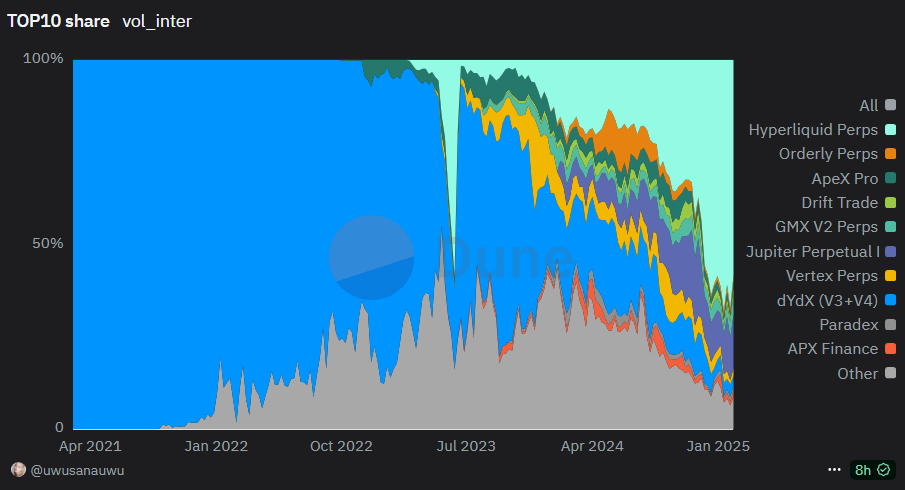

Hyperliquid is an on-chain perp exchange that has introduced a Dutch auction mechanism to facilitate the issuance of new spot tokens. Its revenue primarily stems from perp trading fees, HIP-1 auction fees, spot trading fees, and HLP MM PnL. Currently, Hyperliquid has emerged as the largest on-chain derivatives exchange, capturing approximately 60% of the market share in trading volume.

(Data Source: https://dune.com/uwusanauwu/perps)

The Hyperliquid platform token, HYPE, can be seen as having a dual deflationary mechanism. A portion of Hyperliquid's platform revenue (i.e., USDC fees) will go into the Hyperliquid Assistance Fund, which is used to support the buyback of the platform token HYPE. According to HypurrScan data, as of February 10, since the TGE at the beginning of December, the Hyperliquid Assistance Fund has spent approximately 149 million USDC to buy back 14.693 million HYPE tokens, representing 1.47% of the total supply, with an unrealized profit of about 194 million dollars.

On the other hand, the supply is reduced by burning HYPE from trading fees. The HYPE portion of the HYPE/USDC spot trading fees is directly destroyed, which further decreases the circulating supply. HYPEBurn data shows that, as of February 10, 153,100 HYPE tokens have been burned through transaction fees.

(2) Jupiter: More Than Just an Aggregator, with a Diverse Business Model and 50% of Protocol Revenue for Token Buybacks

As the largest DEX aggregator on Solana, Jupiter has virtually no competitors in the aggregator space, thanks to the hot market conditions on the Solana. According to DeFiLlama data, over the past 24 hours, Jupiter's aggregated trading volume reached a staggering $3.224 billion, which is 7-8 times higher than the second-ranked OKX (approximately $411 million).

Unlike other aggregators that solely focus on their aggregator products, Jupiter actively expands into other businesses, including Jupiter Perp, DCA, Swap API, and fiat on-ramps. The primary revenue stream comes from Jupiter Perp. Although Jupiter Perp holds a much smaller market share compared to Hyperliquid in the multi-chain on-chain perpetual futures market, it is undeniably the leading force on the Solana network.

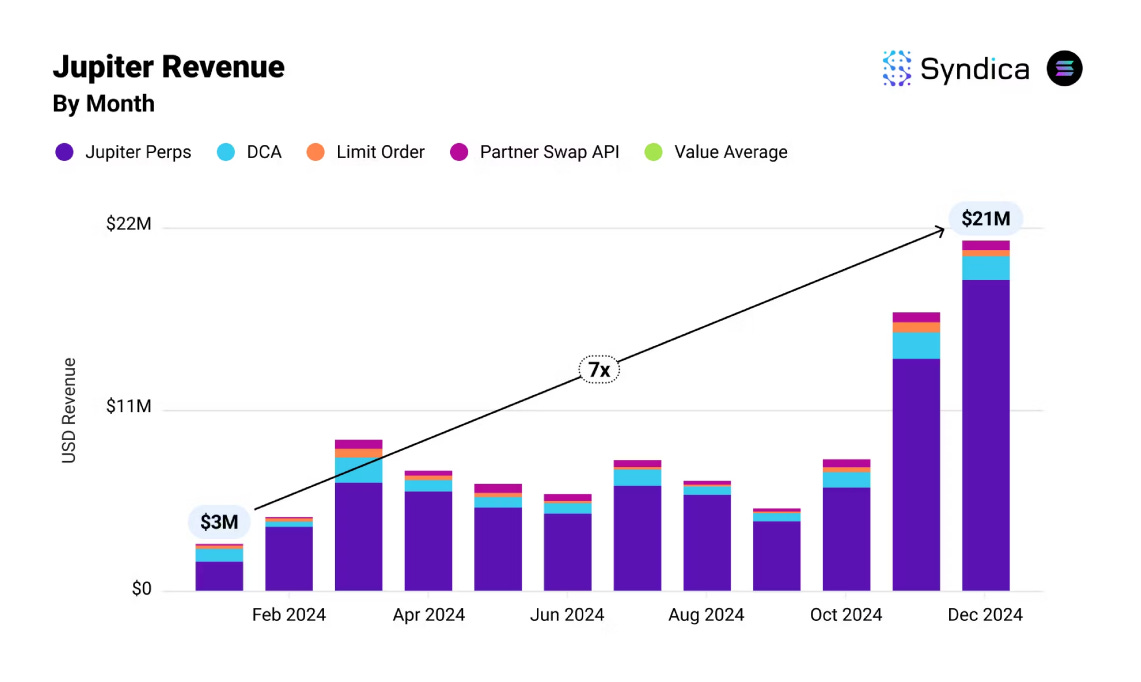

(Data Source:https://blog.syndica.io/deep-dive-solana-dapps-revenue-december-2024/)

According to Syndica data, in December 2024, Jupiter's protocol revenue reached $21 million, setting a historical high and surpassing January of the same year by more than 7 times; over the entirety of 2024, Jupiter's protocol revenue amounted to $102 million.

In late January of this year, Jupiter officially announced that 50% of the protocol's revenue would be used to buy back JUP tokens. If calculated based on the full-year revenue of 2024, this equates to $50.1 million annually for buybacks, which represents 0.6% of the current JUP FDV and 2.28% of the JUP MC.

(3) Raydium: Solana's Largest DEX with 12% of Each Transaction Fee Used for Token Buybacks

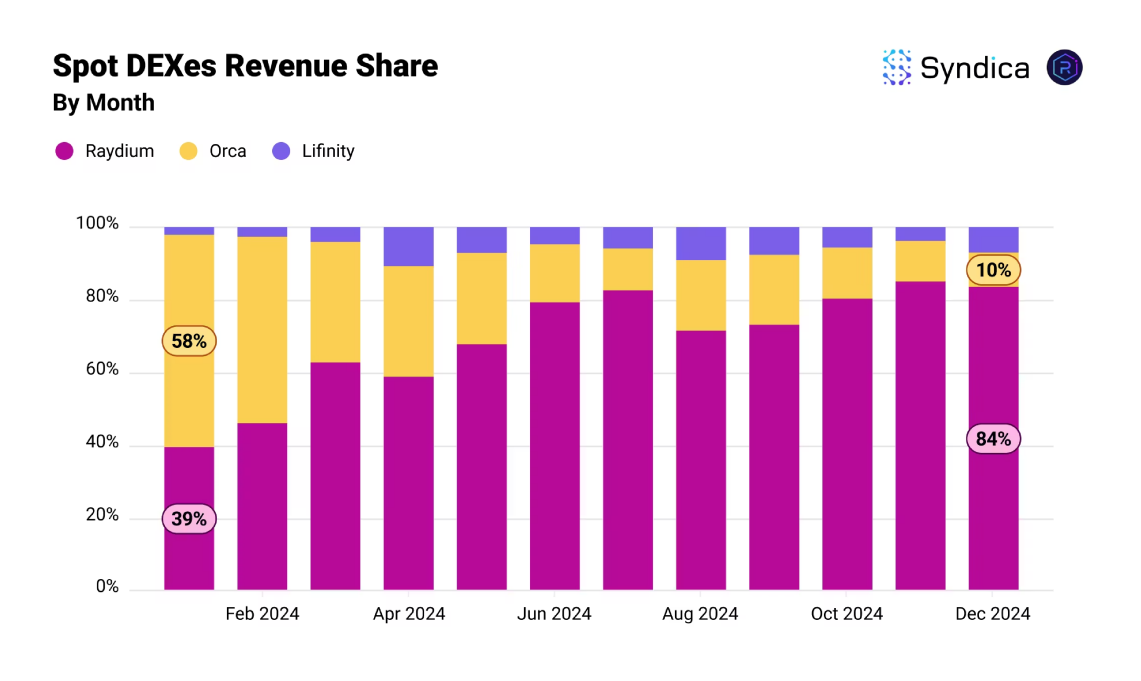

In the second half of 2024, Solana surpassed Ethereum DEXs to become the network with the highest on-chain trading volume. The trading volume on Solana DEXs exceeded $630 billion for the entire year of 2024, with Raydium growing from a market share of less than 40% at the beginning of the year to over 80% by Q4, establishing itself as the absolute leader in the market.

(Data Source:https://blog.syndica.io/deep-dive-solana-dapps-revenue-december-2024/)

Compared to Jupiter, Raydium's revenue model is much simpler. Every trade in Raydium Pool requires payment of a certain transaction fee; for example, the standard AMM Pool transaction fee is 0.25%, while the CLMM Pool transaction fees vary between 0.01% and 2% across eight different tiers. Out of the collected transaction fees, 84% is distributed to LPs, 12% is used for RAY token buybacks, and 4% goes into the treasury.

According to DeFiLlama data, Raydium captured approximately $664.4 million in fees in 2024, meaning about $79.728 million was used for RAY token buybacks throughout the year. This represents 3% of the current RAY FDV and 5.75% of the RAY MC.

(4) GMX: AMM Perp Representative with Staking Dividends

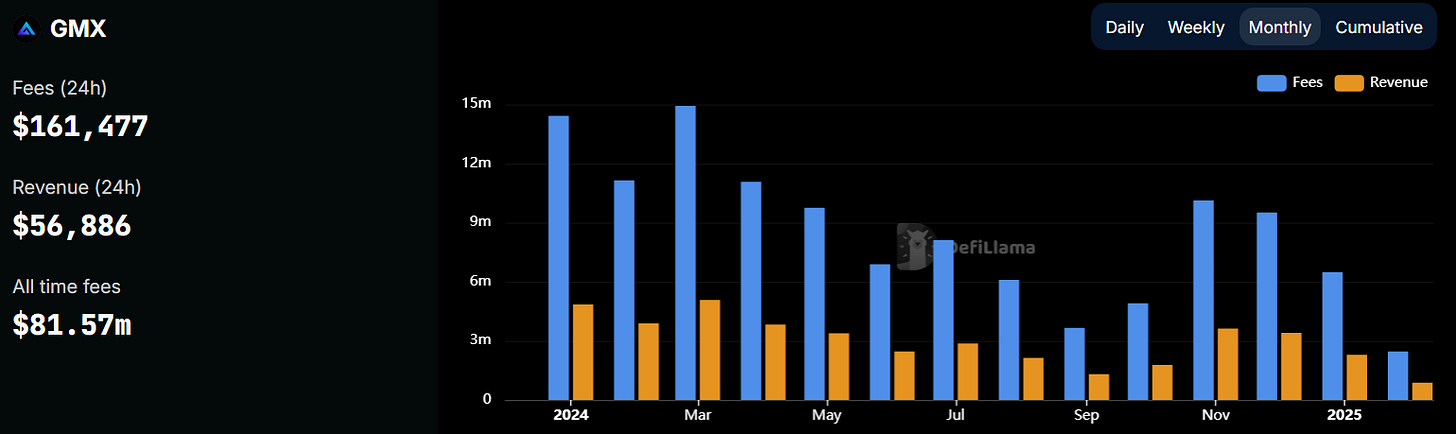

As one of the early on-chain derivatives exchanges, unlike the current mainstream order book model, GMX employs an Automated Market Maker (AMM) model for perp trading. Users supply assets (like ETH, BTC, stablecoins) to GMX's GLP pool to act as counterparties to GMX Traders. However, compared to order book models, AMM Perp is less suited for running strategies and more appropriate for low-frequency trading, leading GMX to show characteristics of high open interest but relatively low daily trading volume. Despite challenges from order book Perps like Hyperliquid, DeFiLlama data indicates that GMX still captured approximately $111 million in fees in 2024, with five months exceeding $10 million in fee capture.

(Data Source:https://defillama.com/fees/gmx)

Of the fees captured by GMX trading, 30% from v1 and 27% from v2 are distributed as rewards to GMX stakers. Based on the total fees for 2024, this equates to approximately $30-33 million in fee dividends. Currently, 64% of GMX tokens in circulation are staked, with a present value of around $145 million, yielding an annualized return exceeding 20%.

(5) Banana Gun: A Veteran TG Trading Bot Facing Challenges with Token Dividends

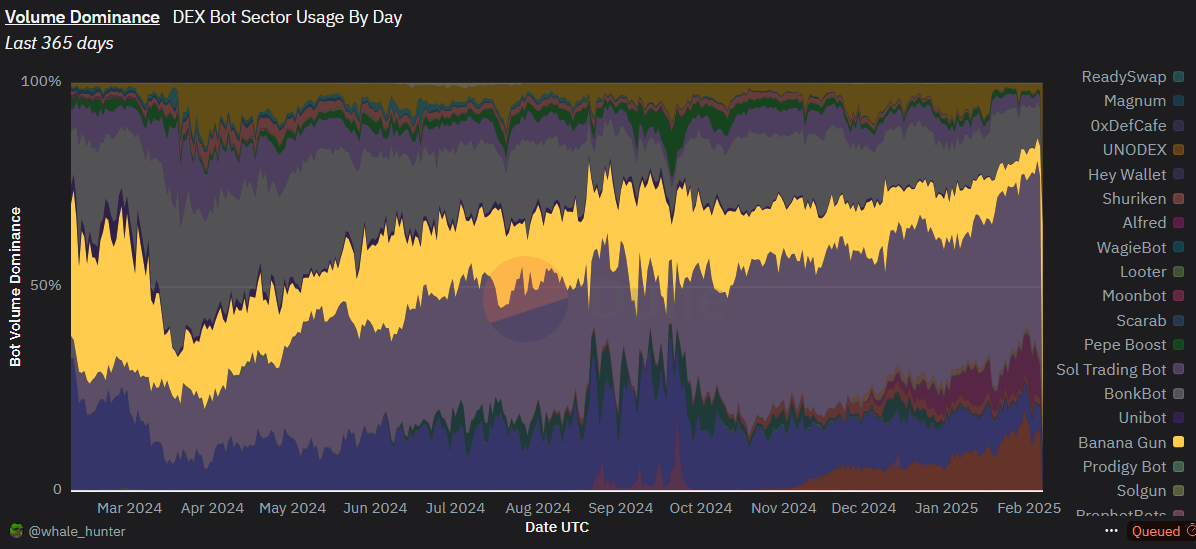

As one of the first Telegram bots to issue tokens, Banana Gun once captured nearly $9 million in fee income in a single month in March 2024, and at one point held over 30% of the market share in the multi-chain network TG trading bot sector. However, as the number of competitors in the TG trading bot sector has significantly increased, on-chain Meme trading has shifted from Ethereum to Solana, and platform-based Meme trading tools such as BullX, Photon, and GMGN have begun to challenge TG Bots, Banana Gun's market share has gradually declined to 5%-10%.

(Data Source:https://dune.com/whale_hunter/dex-trading-bot-wars?Timeframe+in+Days_n793f0=365)

Despite the decline in market share, the overall on-chain trading volume has significantly expanded, making Banana Gun, as a veteran TG trading bot, one of the most profitable applications in 2024. Banana Gun charges a 0.5% fee for manual purchases and limit orders on Ethereum, and a 1% fee for Ethereum auto-sniping and transactions on other chains. According to DeFiLlama, Banana Gun generated $57.8 million in fee revenue throughout 2024, which is approximately 33.6% of the current BANANA FDV and 81.5% of the BANANA MC.

BANANA holders who join Banana Gun through a referral link only need to hold more than 50 BANANA in their wallet to automatically accumulate 40% of Banana Gun's trading fees every 4 hours. This equates to distributing $23.12 million of 2024 revenue to holders in the form of ETH/SOL or BANANA, with BANANA allocations sourced from secondary market buybacks using trading fees.

Additionally, users who trade through Banana Gun receive small amounts of BANANA as rewards through the Banana Bonus cashback program. By turning traders into token holders and token holders into traders, Banana Gun is building an ecosystem loop for BANANA and TG Bot.

Currently, most on-chain protocols willing to share protocol revenue or conduct token buybacks are related to asset trading, including spot trading, perpetual trading, and aggregated trading. This demonstrates that on-chain asset trading can generate robust revenue, motivating teams to empower their tokens. Compared to centralized exchanges charging 0.02%-0.075% in fees, on-chain platforms often impose fees as high as 1% per transaction.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Comments

Post a Comment