Predictions for 2023 Part 3

Author: Blofin Academy

Next year’s macro trend forecast:

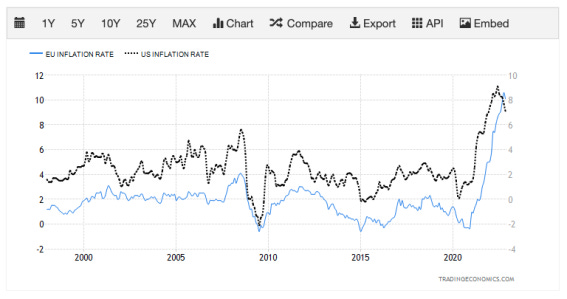

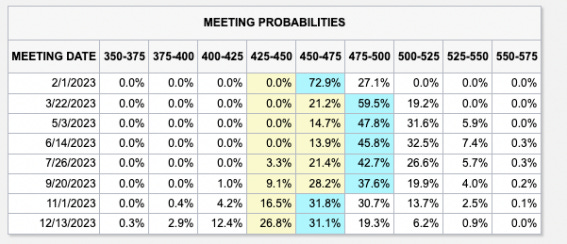

In the first half of next year, the crypto market will still face strong liquidity pressure. The November-December economic data showed that while signs of recession in the US and Europe are becoming apparent, more data supported that the US economy “remains strong”, providing enough evidence for the Federal Reserve to maintain hawkish policy through 2023; Stubbornly high inflation in the region leaves the ECB little choice but to keep raising rates aggressively.

Although the Fed began tapering off interest rate hikes in December 2022, inflation is far from returning to normal levels. As a result, the Fed’s “peak interest rate” will remain in place for at least six months. Traders in the interest rate market now expect rates to peak in March 2023 and last until at least November. As a result, liquidity pressure in the crypto market will remain high, and a rebound in prices and a market recovery are still a long way off.

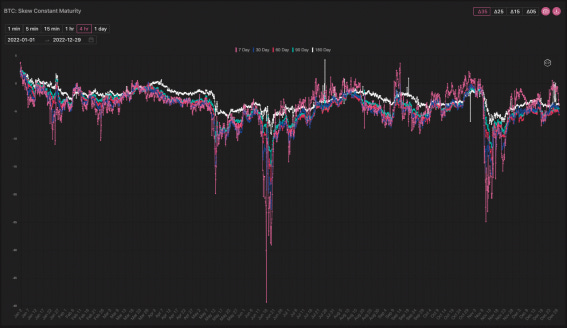

In the options market, mid-forward sentiment remains relatively bearish, not significantly improved from the start of 2022. Given the concentration of professional investors in the crypto options market, the crypto market is likely to continue to suffer in 2023.

Crypto Sector Prediction:

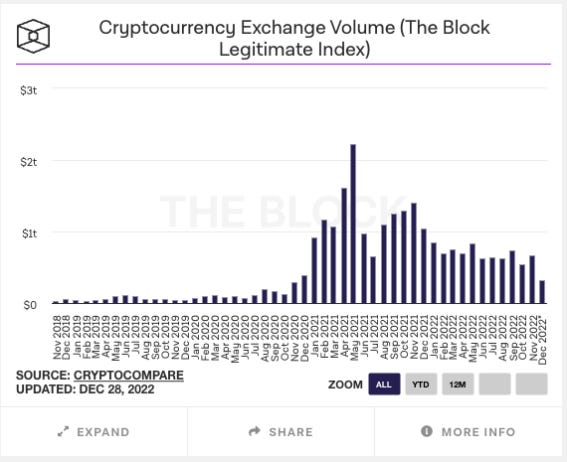

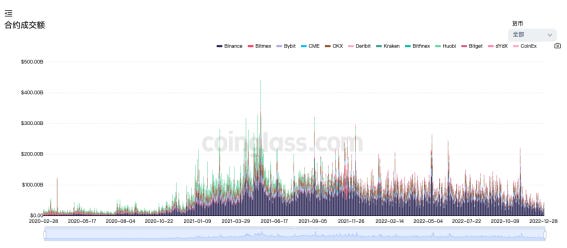

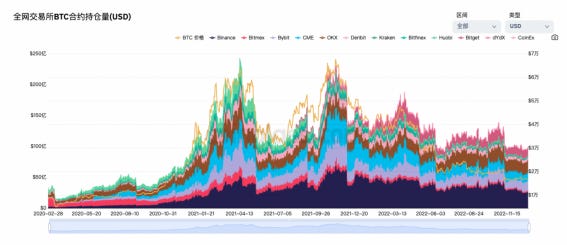

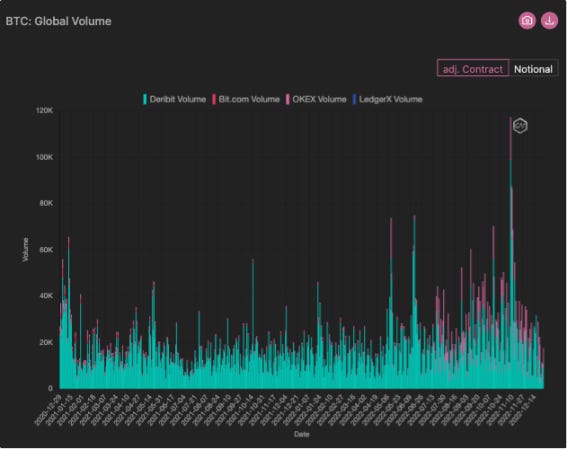

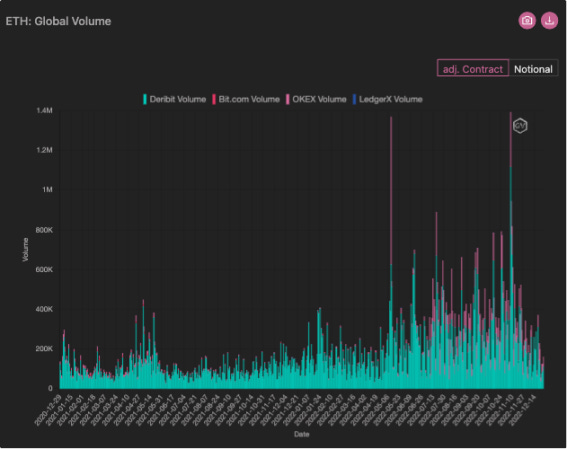

From the perspective of trading volume, both spot and future markets will shrink significantly in 2022 compared to 2021. Monthly exchange turnover in the spot market has fallen to late 2020 levels, while volume in the future market has behaved similarly to the spot market.

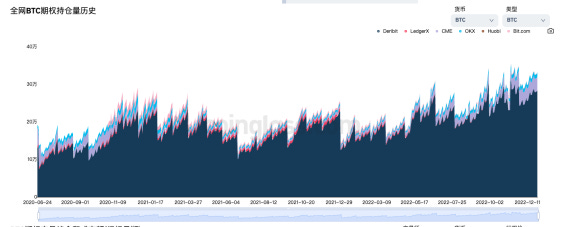

However, traders in the future market remain relatively active from an open position perspective. Mainstream crypto future holdings, while below the bear market peak, are on par with the early and trough of the bear market — suggesting that the future market is likely to remain relatively liquid and trading opportunities through 2023. Given the stellar performance of decentralized derivatives exchanges such as GMX and dYdX in 2022, the derivatizes-related sector will also be a key node for attracting traffic in 2023.

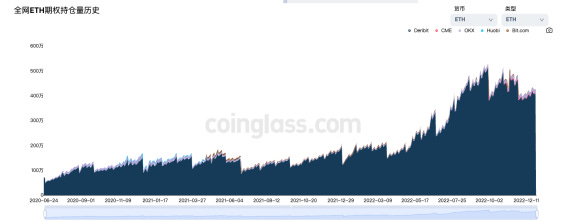

It is worth noting that the crypto options market has not been significantly affected by the bear market. The options market significantly outperformed 2021 in terms of both open interest and volume. As there are many unstable factors in the market in the bear market environment and relatively few stable and safe interest-bearing instruments and products, crypto options are favored by many investors in 2022 due to their high interest-bearing attributes and effective management ability of multiple risks.

In addition, due to the concentration of professional investors and institutions in the option market, the Analysis of changes in the option market can help effectively judge the possible operation and expected direction of the crypto market to a large extent. It is expected that the options-based sector (centralized/decentralized options trading business, structured products, options market data Analysis, etc.) will further develop in 2023 as more professional institutions, market makers, and individual investors join the market.

Author: ZhiXiong Pan, the Founder of ChainFeeds

The next year is expected to see the release of indie or AAA games that VCS have been spending money on, and there could be a lot of bubble. Whether gaming is the best direction for Web3 startups will likely continue to be a question mark.

There shouldn’t be any obvious breakthroughs on the technical side, but the protocol layer will continue to improve and be easy to use, and downstream developers will be more likely to develop productively efficient applications and products.

Continue to focus on modular Web3 applications, which will continue to integrate more native components to provide real value products.

Continue to be negative about the role of token economics in Web3, many Web3 entrepreneurs may still be obsessed with the initial flow brought by token economy, but whether it can really maintain long-term value, looking forward to next year more entrepreneurs can try again.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Comments

Post a Comment