Bitcoin or Monero? We asked ChatGPT-4o which is the best buy for this bull market cycle

As this cryptocurrency bull market cycle heats up, Finbold asked ChatGPT-4o for a comparative Analysis between Bitcoin (BTC) and Monero (XMR). The advanced OpenAI model provided a comprehensive breakdown of both cryptocurrencies, considering their fundamentals, supply and demand dynamics, and growth potential.

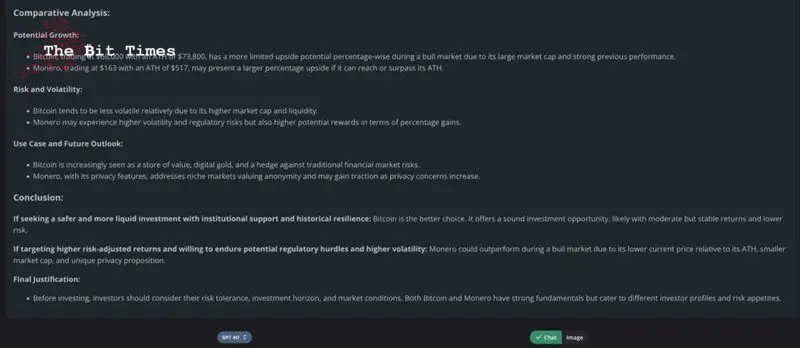

First, ChatGPT-4o highlighted Bitcoin’s dominant market position, trading at $67,930 with an all-time high (ATH) of $73,800. Meanwhile, Monero’s current price of $163, compared to its ATH of $517, suggests significant room for growth. However, the artificial intelligence (AI) emphasizes that the decision ultimately depends on individual risk tolerance and investment goals.

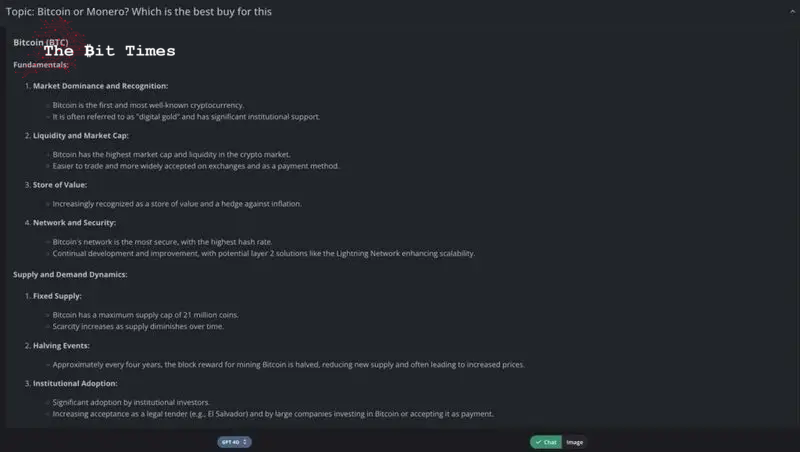

Bitcoin’s strengths lie in its market dominance, institutional support, and recognition as a store of value. Additionally, its fixed supply of 21 million coins and regular halving events contribute to its scarcity and potential price appreciation. On the other hand, Monero’s privacy features and strong development community set it apart in the cryptocurrency landscape.

Picks for you

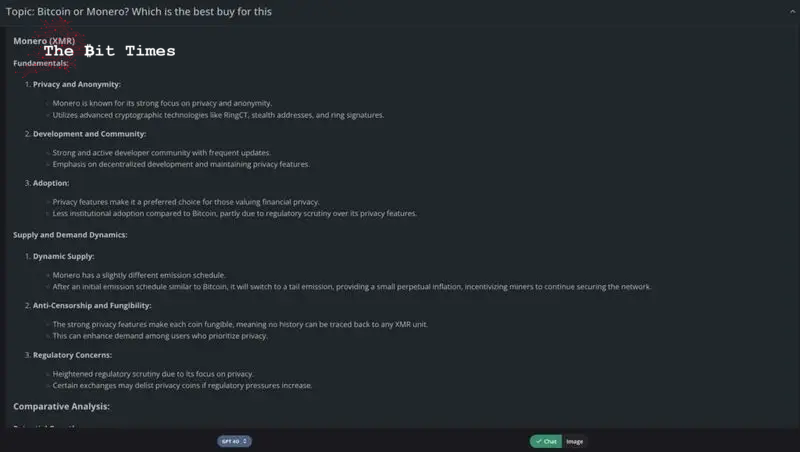

Interestingly, Monero has been constantly dethroning Bitcoin as a medium of exchange in gift card platforms and darknet markets.

The future of crypto: Bitcoin vs. Monero

ChatGPT-4o delved deeper into the unique characteristics of each cryptocurrency. Bitcoin’s status as “digital gold” and its increasing adoption by institutions and even countries as legal tender bolster its long-term prospects. Moreover, its high liquidity and market cap make it a relatively stable investment option in the volatile crypto market.

Conversely, Monero’s focus on privacy and anonymity appeals to users who prioritize financial confidentiality. The AI noted that Monero’s dynamic supply model, which includes a tail emission, could provide long-term incentives for miners to secure the network. However, regulatory concerns surrounding privacy coins may pose challenges for Monero’s widespread adoption.

Risk vs. Reward

In conclusion, ChatGPT-4o presented a nuanced view of both cryptocurrencies. Bitcoin offers a safer investment with moderate but stable returns and lower risk, making it suitable for risk-averse investors seeking exposure to the crypto market. Its institutional backing and historical resilience provide a solid foundation for long-term growth.

Monero, however, presents an opportunity for higher risk-adjusted returns, albeit with increased volatility and potential regulatory hurdles. Its lower current price relative to its ATH and smaller market cap suggest the possibility of outperforming during a bull market. Nevertheless, investors must carefully consider their risk tolerance and investment horizon before making a decision.

Ultimately, ChatGPT-4o emphasized that both Bitcoin and Monero have strong fundamentals but cater to different investor profiles. As the crypto market continues to evolve, investors should stay informed about market conditions and regulatory developments to make the most informed decisions possible.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment